Details

Details

In 2017 the Native Advertising Institute (NAI) took on an ambitious project to map the entire native advertising technology landscape. It was a lot of hard work, but it paid off.

It was never done completely before but received a lot of positive feedback and it was decided to make this an annual tradition. Therefore, NAI continued after publishing last year’s landscape to add to the list of technology vendors throughout the year and will continue to this year, as well. So, with the new year comes the updated landscape.

Once again, our hope is that this effort will help move forward this emerging industry.

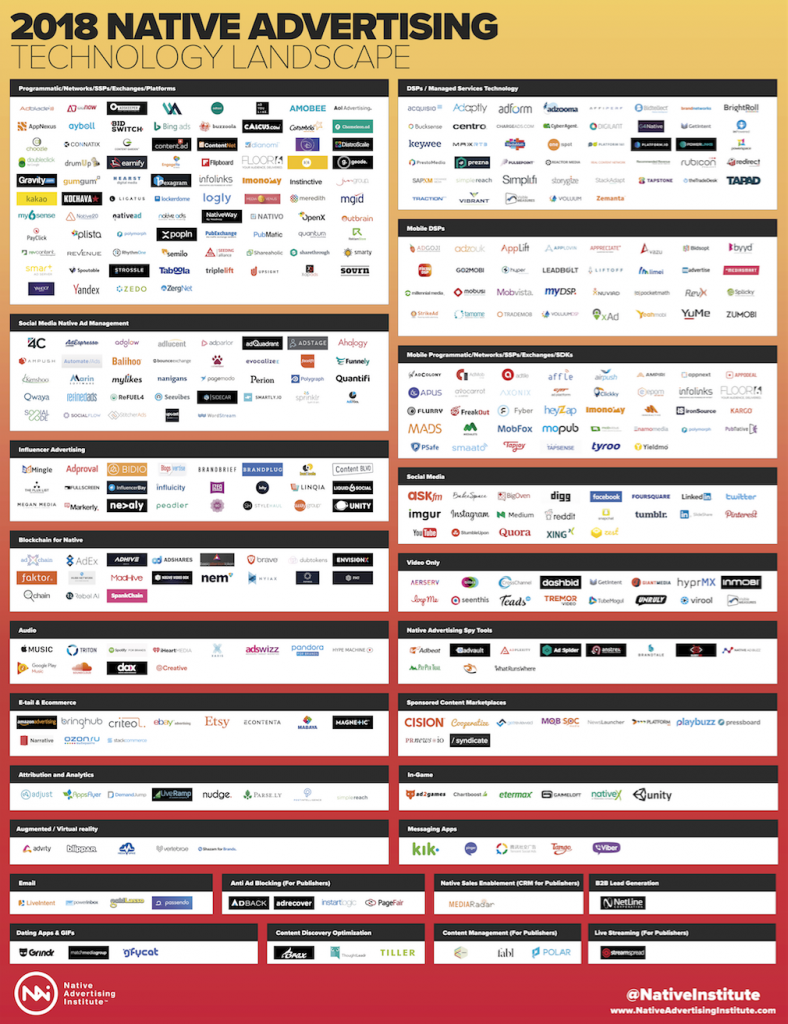

I and NAI are proud to announce the release of the 2018 native advertising technology landscape. Several new categories have been added this year. The number of vendors has grown from 272 to 402, reflecting the predicted growth trajectory for native advertising as a discipline.

Like last year, the new landscape also reflects the global focus of NAI. It includes vendors that exclusively operate in Russia, Germany, Middle East, China, Switzerland, Turkey, UK, and many others. Many vendors are truly global in their reach. This research was produced to act as a resource for publishers, marketers, advertisers, media buyers, communicators, and ad tech folks.

The 2018 Native Advertising Technology Landscape

Click on the landscape to view full screen

Download high-resolution versions

2018 Native Advertising Technology Landscape (1200 dpi JPEG)

2018 Native Advertising Technology Landscape (PDF)

Items worth noting

- NAI explicitly grants permission for anyone to republish this landscape and share it across blogs, social media, presentations or wherever it’s appropriate. NAI does not grant permission to change the graphic from its original design unless it is expressly agreed upon.

- This is not a perfect rendition of the landscape. Content on each vendor’s website was used to determine if they had anything to do with native advertising. Some had just a small part of their technology dedicated to native. Others were all in on native. If there’s any errors in categorization or missing vendors email NAI at hello(at)nativeadvertisinginstitute(dot)com so it can be corrected for 2019.

- No vendor is represented more than once in the landscape. Many technically fall under more than one category. They’ve been placed based on their greatest perceived value proposition in the marketplace.

- Many of these vendors are also represented in NAI’s native advertising technology directory. It’s complete with descriptions, links, and in some cases, additional media. New vendors will be added throughout the year. If any vendor wishes to be featured more prominently in the directory leave a comment below or contact NAI at hello(at)nativeadvertisinginstitute(dot)com

- Acknowledging every source would be implausible since the research was conducted by visiting hundreds of websites. Instead, the key sources are acknowledged here: BuzzSumo email alerts, Forrester, ChiefMartec, Thalamus, Nudge and PubNative.

Native Advertising Technology Vendors

In order for a vendor to make this list it had to meet two criteria:

- Help facilitate, optimize or track native advertising

- The native advertising must meet NAI’s definition (see definitions below)

Definitions

Since native advertising terminology varies across geographies, marketing departments and publishers, it’s important to shed some light on some of the language associated with the industry. Most content marketers and some publishers aren’t necessarily experienced online media buyers or ad tech folks.

- Native Advertising – paid advertising where the ad matches the form, feel and function of the content of the media on which it appears

- Demand Side Platform (DSP) – a system that allows buyers of digital advertising inventory to manage multiple ad exchange and data exchange accounts through one interface

- Supply Side Platform (SSP) – a technology platform to enable web publishers to manage their advertising space inventory, fill it with ads, and receive revenue

- Ad Exchange – a technology platform that facilitates the buying and selling of media advertising inventory from multiple ad networks

- Ad Network – a company that connects advertisers to web sites that want to host advertisements

- Programmatic Advertising – technology that helps automate the decision-making process of media buying by targeting specific audiences and demographics using artificial intelligence, machine learning algorithms and real-time bidding

- Content Discovery – technology that helps people discover content they may like but never knew existed

- Influencer Advertising – a form of paid advertising in which individual influencers are conscripted to organically share media for an advertiser

- Sponsored Content – content in an online publication which resembles its editorial content but is paid for by an advertiser

- Managed Services Technology – a DSP with managed services

- Software Development Kit (SDK) – a collection of software used for developing applications (mostly mobile applications in native advertising) for a specific device or operating system

- Platform – a third-party network that allows advertisers to publish text, graphics, videos or animations on websites and/or applications

- Blockchain – a digitized, decentralized, public ledger of transactions where information exists as a shared—and continually reconciled—database

2018 Native Advertising Technology Statistics

As this is the second year of this research we’re finally able to compare and contrast the changes in the landscape. Some interesting insights were discovered:

- There are 402 vendors represented on the landscape, up 48% from last year

- Two categories were eliminated from the 11 last year and 15 new categories were added for a grand total of 26 native advertising categories.

- A little more than one percent of the vendors from last year were removed because they went out of business, changed their name or were acquired.

- Twelve influencer advertising vendors were added, representing the largest category growth of 50%.

- The mobile-only SSP/SDK/Networks category increased by 28%

- The DSP category grew by 10 vendors, or 22%.

- The mobile DSP and social media native ad management categories only increased by one vendor each, respectively.

It’s surprising that there weren’t more acquisitions and churn throughout the course of the year as more and more native ad tech companies are looking for their share of the year over year growth from native adoption. The overall growth of the native advertising technology vertical was a bit surprising, though. A whole new technology was introduced to the landscape this year – blockchain. This and the growth in the other categories helped drive the overall growth rate to nearly 50%.

Based on overall category growth, influencer advertising is moving the fastest. This isn’t surprising given its popularity among marketers today. It also appears that mobile DSPs and social media native ad management vendors may have hit near their peak saturation in the marketplace. It doesn’t look like there’s much room for new vendors. Perhaps we’ll start seeing consolidation and acquisitions in these two categories throughout the year.

That said, many of the new companies that were added did indeed exist when this landscape was put together last year. However, some of them didn’t come on our radar until later on in the year. This will likely happen this year, too. If any native ad tech companies are missing, please mention in the comments or email NAI at hello(at)nativeadvertisinginstitute(dot)com

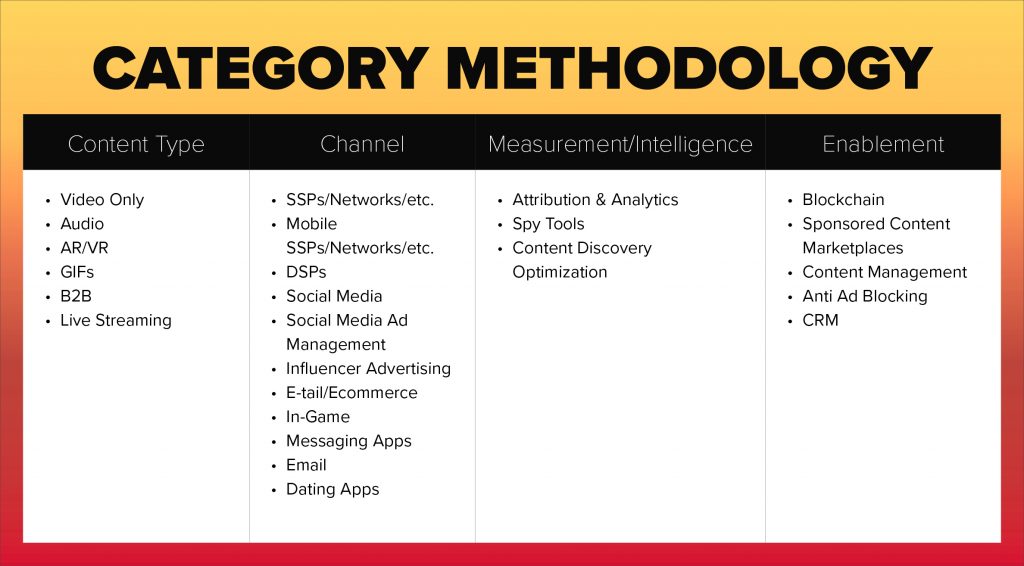

Native Category Methodology

Broadly speaking, the categories fall under one of four descriptive areas

- Content type

- Channel

- Measurement/intelligence

- Enablement

Video-only would be an example of content type, social media would be an example of a channel, attribution and analytics would fall under measurement, and content management is under enablement.

With the exception of the live streaming category, all publisher-only technology falls under either measurement/intelligence or enablement.

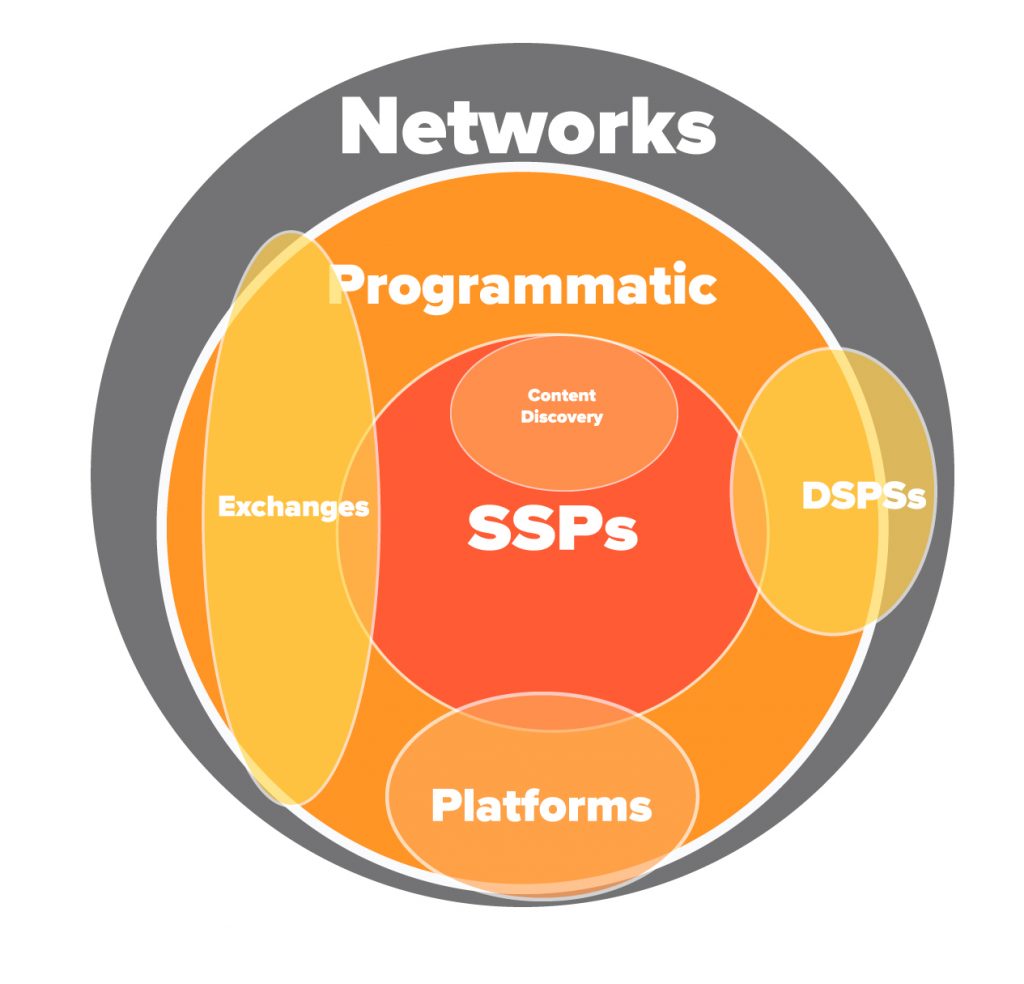

Compared to last year, the category changes that were made are much more helpful to navigate and understand. The trickiest category to fill is still programmatic/networks/SSPs/exchanges/platforms – both mobile-only and device agnostic.

Between the two of them, they represent the largest group of native advertising technology and are the most challenging to organize. There’s so much crossover in their subcategories that a vendor could potentially fall anywhere in the graphic below.

Some of these vendors could be placed in up to six of the sub-categories represented above. Some are both DSPs and SSPs, or programmatic platforms and exchanges. The easiest fix to overcome this categorization problem was to separate DSP-only vendors and place them in their own category. Everyone else that claimed programmatic, network, SSP, exchange or platform were all placed together. In the case of mobile-only, many vendors also considered themselves SDKs, too.

Another subcategory that several vendors claim is content discovery. These are all programmatic SSPs and networks, thus, they’re placed in the greater category. If anyone has any suggestions on a better way to attack this category, please share in the comments or email NAI at hello(a)nativeadvertisinginstitute(dot)com.

Also, categories specifically labeled as mobile are mobile-only. That does not mean that other solutions can’t be used for mobile native advertising, too. Device agnostic vendors with mobile capability are not labeled as mobile. The same holds true for video-only. Many vendors do video and other content types. However, we felt it was important to separate the vendors that focus exclusively on video content.

In addition, only influencer advertising vendors were considered for this landscape – those vendors offering solutions to connect brands with influencers AND help facilitate a quid pro quo (typically monetary) transaction. That makes the vendor paid media which is required based on the above native advertising definition. Vendors that don’t provide the capability of transacting a quid pro quo operation were excluded.

Lastly, while the IAB does consider PPC native advertising, we chose not to include those vendors in the landscape. Based on the IAB’s categories, PPC would be considered the most mature native channel online with nearly two decades of thought leadership behind it. We decided to steer clear and let the PPC experts tackle their technology landscape.

Native Advertising Technology Categories

Fifteen new categories were added this year to provide more clarity and usefulness. Two categories were eliminated and busted up into additional categories. It was also important to highlight the content format where appropriate, so potential users could better navigate the landscape based on their needs.

Categories that are bolded are new this year, ones that are in italics are from last year, and the categories with strikethroughs were eliminated. The first six categories are all new and fall under the broader “content type.” This was done to make navigating the landscape simpler for readers.

- Video Only – while many of the vendors in the landscape provide paid distribution of video content, only the ones that exclusively focus on this content type were included in this category.

- Audio – whether promoting a podcast or natively communicating via Pandora, this category and content type are self-explanatory. We’re expecting significant growth in this category as more and more technology is being developed for brands to gain access to users of voice activated virtual assistants.

- AR/VR – both artificial and virtual reality adoption is on the rise, albeit not as much as the hardware companies would like. With these new environments comes an opportunity for brands to natively engage users.

- GIFs – it seems as if GIFs are popping up everywhere these days – Facebook, Twitter, Tumblr, Instagram. It was just a matter of time before a company decided to let brands sponsor GIFS.

- B2B – over the years I’ve been asked several times which vendors are specifically built for lead gen. Vendors in this category specialize in promoting ebooks, guides, case studies, etc. and place them behind a landing page form.

- Live Streaming – this category actually connects publishers with live video streamers to publish their live content. As of now, it appears to be most popular in the gaming industry and connects to popular broadcasting platforms like Twitch.

- SSPs/Networks/etc. – generally, these are the vendors publishers use to serve up programmatic native advertising units on their sites. However, each subcategory under this category may also offer up unique value propositions outside the scope of the above description.

- Mobile SSPs/Networks/etc. – very similar to the above, but many of these vendors have the ability to serve up native ad units in apps, too. Also, many consider themselves SDKs.

- DSPs – these vendors have multiple SSPs that can connect to them. Generally, they also have a value-added technology layer that helps to optimize media spend, impressions, clicks or engagement.

- Mobile DSPs – very similar to the above, but with access to mobile apps.

- Social Media – much of the media inventory on social media today is native in nature. Most social media platforms now offer native advertising and it’s generally in-feed.

- Social Media Ad Management – these vendors are essentially DSPs for social media. Many of them connect to multiple social media platforms, while a few just connect to Facebook. What makes them useful is their consolidated dashboards and their use of technology to optimize native units and spend.

- Influencer Advertising – these vendors offer up a closed network of influencers to brands and connects them. They pay the influencer for some type of mention or content creation through the vendor’s technology. This category spans many of the social media networks and blogs.

- E-tail/Ecommerce – while native advertising is generally seen as a top of the funnel distribution channel, these vendors offer up in-feed units to consumers when they’re in the purchase or decision stage of their buyers’ journey.

- In-Game – these vendors fall across the gaming spectrum. They typically focus on just one gaming channel – consoles, mobile, or computer. Brands that want to get in front of gamers can leverage one of these vendors’ solutions.

- Messaging Apps – Many of the messaging apps that are highly popular outside of the United States have some types of native in-feed unit available to brands. As I write this, I saw my first in-feed unit in Facebook Messenger. It was already too late to add them to the landscape, though. We’ll see them next year.

- Email – the feedback on some of the vendors in this category has been very positive. Email has long been the highest performing, on average, of any online channel. It makes sense to expect this native channel to outperform many of the others.

- Dating Apps – perhaps I’m aging myself here, but admittedly, I have no experience with this genre of technology. However, that doesn’t mean it’s not a viable native advertising channel, either.

- Attribution & Analytics – this category included AI-driven analytics, mobile-only analytics, speciality analytics just for publishers and their sponsored content, attribution, content intelligence and cross-device identity resolution. Some of these vendors perform more than one of the items described above.

- Spy Tools – ever want to see how your competitors are doing native advertising or want a glimpse of their performance? That’s what these vendors do. Most of them allow you to download targeting information, images, ad copy and even the entire landing page it links to.

- Content Discovery Optimization – these vendors either make content discovery units perform better for a brand (improved engagement) or a publisher (maximize click-through rates and/or impressions). Think A/B testing for content discovery.

- Blockchain – vendors for this category are either foundational technology that native advertising companies are built on top of or are the actual native advertising company. This is an exciting technology because it eliminates waste, fraud, abuse and IOs.

- Sponsored Content Marketplaces – think of these vendors as dating websites that pair together publishers with brands to produce and publish long-form sponsored content.

- Content Management – vendors in this category help publishers launch long-form content on their sites. Some of them have specialized analytics, testing functionality and multimedia capability.

- Anti-Ad Blocking – these are the tools publishers can use to fight back against ad blocking software. It helps improve revenue by opening up blocked inventory.

- CRM – this category helps publishers sell more native and non-native inventory. It’s built specifically with publisher’s needs in mind.

Sponsored Content (long-form)– the reason this category was dropped is that it included any technology vendor that touched long-form sponsored content from publishers. By breaking up the category we hope to shed more light on the tools publishers can take advantage of to get the most out of their native advertising.Native Advertising Intelligence– this category previously included analytics, attribution and spy tools. They were split up because their value propositions were much different. Spy tools are generally used by marketers and the rest in this defunct category are used by publishers.

Conclusion

Your feedback on this annual tradition is deeply appreciated. It’s this feedback we use to make the outcome of our research the most impactful for you. If we missed your native ad tech company this year, please let us know so we can include you in next year’s.

Everyone is highly encouraged to leave a feedback below or to NAI directly at hello(at)nativeadvertisinginstitute(dot)com.

Just like last year, not a single vendor represented in the above landscape paid NAI or myself to influence this project whatsoever. It was an organic effort and shall remain one. With nearly a 50% YoY increase in native advertising technology vendors, what do you think next year will bring?

Could the growth of this vertical stagnate due to acquisitions and consolidation? The media spend on native will certainly continue to grow. It’s estimated to break $28 billion dollars in 2018 in the US alone – and that’s just programmatic.

At its current rate of growth, we would see a total of 685 native ad tech vendors next year. Maybe the rate will slow down or even increase. We won’t know the answers to any of these questions until 2019.

In the meantime, this research and a bonus chapter on programmatic native advertising best practices are laid out in a full ebook available as a free download.

Also, don’t forget that most of these vendors are featured in NAIs Native Advertising Technology Directory – complete with links, contact information, descriptions, and in some cases, additional media. Let NAI know if you need to be featured or if you would like to upgrade your account to premium and appear at the top of your list and include more information on your profile. Contact NAI at hello(at)nativeadvertisinginstitute(dot)com.

Download the "Global Guide to Native Advertising Technology 2018"